Freelance Finances for Dummies

When I first went freelance, I thought I was doing alright. Then I got a letter from the IRS saying I had made so little money that I didn’t owe taxes for that year.

Welp.

Money is the thing that makes the world go ‘round. It decides where we live, what we eat, what projects we say yes to—and what we can’t afford to walk away from. And yet, no one really teaches us how to handle it. Discussing money is a taboo subject in many cultures. If you’re a freelancer, the prospect of not having a steady paycheck becomes really daunting and overwhelming which is why financial literacy is so crucial.

So let’s talk about it.

Step One: Know Your Survival Number

I’m going to introduce you to a really obvious but rarely practiced rule: Spend less than you earn.

Yes, it sounds basic and obvious. But no, it’s not quite as simple as that.

First, figure out your monthly fixed expenses—rent, groceries, bills, insurance—and calculate the bare minimum you need to survive. Let’s say that’s $2,000/month. That’s your minimum threshold. Now add a buffer, because one flat tire or surprise medical expense and you’re suddenly out of money you don’t have.

A more sustainable goal might be $3,000/month so you’ve have enough money for fun and savings and you’re not in survival mode all the time. Tools like Google Sheets, FreshBooks, Rocket Money, or QuickBooks can help you track how much you're earning and where it's going. Seeing your income broken into quantifiable categories will show you whether you're doing alright or slowly bleeding money.

Step Two: Budget

A traditional 9-5 job gives you structure and stability. Freelancing gives you chaos and unpredictability. But that’s why we chose this path, right?

One month you can make $20K, the next you made zilch because no projects came through. That’s why budgeting as a freelancer means planning for fluctuation and being able to weather the storms. Aim to base your budget on your average monthly income, not your best month ever. The longer you freelance, the more you’re able to gauge how much money you typically make in a year which means you can pay yourself a steady salary out of your business account.

Step Three: Taxes

Traditional jobs will automatically take taxes from your salary. Freelance jobs do not. It’s great when you get the invoice paid because you get a huge lump sum all at once and you feel rich. Until tax day rolls around and you realized you have to pay a shit ton in taxes.

Look, you’re now your own employer. Treat yourself like one. Save 20-30% of every paycheck for taxes. Put it in a high yield savings account where it’ll generate interest. Ignore that money. You’ll thank yourself once tax day comes around.

Freelancers usually pay quarterly taxes, which yes, are annoying. But they help you avoid a giant lump-sum surprise in April. Quarterly taxes let you check in with your business four times a year and help you gauge whether the quarter has been busy or slow and if you need to adjust your outreach strategy.

Apps like QuickBooks or a good accountant can help estimate what you owe.

Step Four: Figure Out Your Rate

When I got my first freelance gig straight out of college, I had no idea what to charge. The studio asked for my rate, and I immediately texted classmates in full panic. Someone said $35/hour for juniors was fair so I went with that.

Over time, I realized this is a huge learning curve for everyone. That’s why it’s vital to talk about rates with your freelance friends—transparency helps us all get paid fairly.

Here’s a rough guide for motion designers:

- Junior: $300–400/day

- Mid-Level: $400–600/day

- Senior: $700–1,000+/day

Where you live matters (NYC and LA pay better than rural towns), and so does where your client is based (U.S. clients usually pay more than European ones). You won’t always get your full rate—but having one makes it easier to say no to underpaid gigs. And look, I’ll charge corporate clients more while accepting a reduced rate with non-profit clients because I understand both of them have very different levels of money that they can spend.

Step Five: Emergency Funds

Even if you’re charging $1,000/day, that doesn’t mean you’ll be booked every single day. A solid year is maybe 60–80% booked. That’s why emergency funds are your ride-or-die.

The goal: save at least 6 months’ worth of expenses. That gives you a safety net if work slows down or you just need a mental health break. I personally keep a year’s worth of expenses saved, because I’m ✨ anxious ✨ but it’s nice knowing I can go a long time without work.

The easiest way to save? Automate it. Apps like Acorns, or most bank apps, will let you auto-transfer a small percentage from each paycheck into savings. Even $20 here and there adds up. And having that cushion means you can actually afford to turn down nightmare gigs or red flag clients.

Step Six: Invest in Yourself

Once you’re out of survival mode, start planning for retirement—even if it feels like a lifetime away.

Freelancers don’t get 401(k)s handed to them. But you can still invest through a Roth IRA, SEP IRA, or solo 401(k). The earlier you start, the more compound interest can work its magic. It takes a long time before the compound interest starts to seriously make any gains but once it does, it’s glorious. It’s like free money.

I use a robo-advisor through Betterment because I don’t understand how the stock market works. They ask a few questions about your goals and risk tolerance and then do the rest for a small fee. If you’re more hands-on, people love low-fee index funds like the S&P 500 via Fidelity, Vanguard, or Schwab.

Step Seven: Lean on Your People

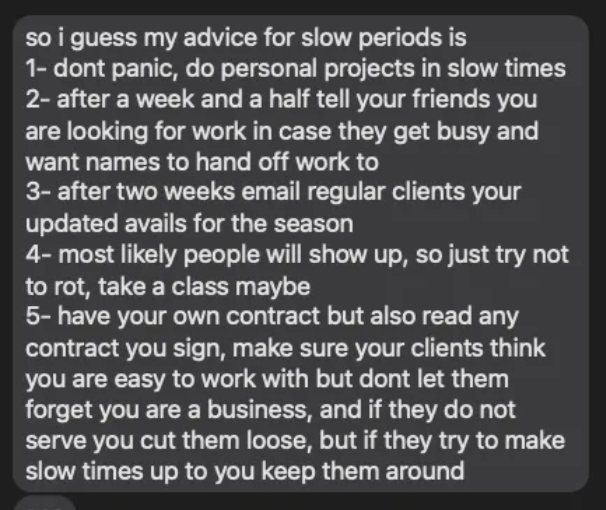

I asked my fellow freelancer friend Andrea Schmitz what advice she’d give, and she said:

Freelancing is an emotional rollercoaster. Some months feel like you’ve peaked and you’re at the top of the world, other months feel like you’ll never work again. The key is to use your downtime well: learn a new tool, build a personal project, update your portfolio, reading that book you’ve put off forever.

Personally, I’ve used slow periods to learn tools like Cavalry and TouchDesigner, and taken courses through School of Motion. I know my strengths—2D/3D hybrids with bold, colorful visuals—and I know what I don’t do. That clarity helps me target the right clients and the right projects.

And honestly? Most of my success came from other people. I have a trusted circle of motion designer friends I can bounce rates off of, refer projects to, and learn from. We help each other stay booked, grounded, and paid.

In Conclusion

Money can be scary, but it doesn’t have to be. Figure out your expenses, know your worth, and give yourself permission to take control. There’s no one right path—some freelancers work aggressively hard to maximize their profits, others work less to focus on family or creative freedom. Every person is different.

Money doesn’t buy you happiness but it does give you the freedom to pick and choose the projects you work on which is everything.